Report: What will happened with rents on warehouse market? Will the rents rise?

The period of the greatest declines in effective rents is already behind us. According to the latest AXI IMMO’s report, transaction rents remain very low only in the case of very large contracts over 10,000 – 15,000 sq m. What can we expect in the forthcoming months?

The period of the greatest declines in effective rents is already behind us. According to the latest AXI IMMO’s report, transaction rents remain very low only in the case of very large contracts over 10,000 – 15,000 sq m. What can we expect in the forthcoming months?

Rents for warehouse space in 2016

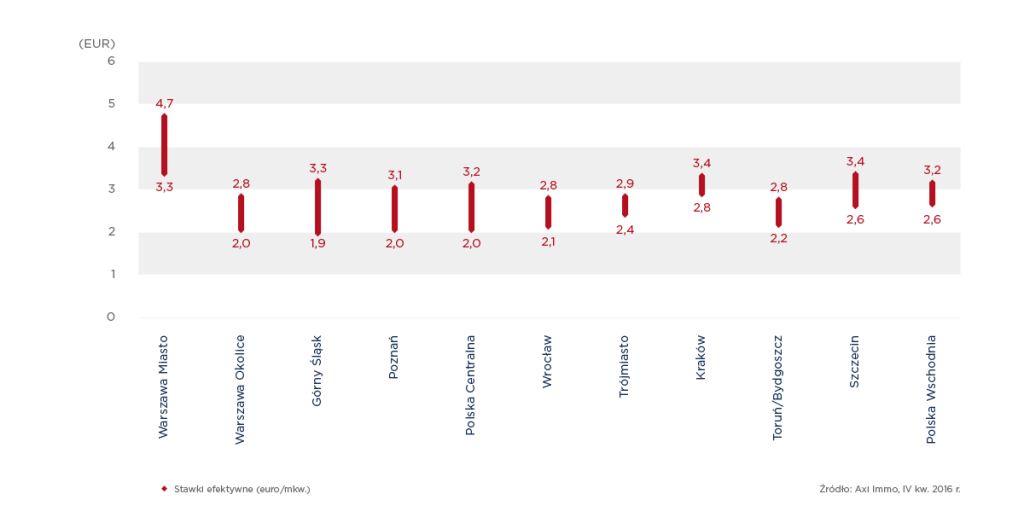

In 2016 the most attractive effective rents were obtainable in the Warsaw area (EUR 1.90-2.40/sq m) and in selected locations in Upper Silesia and Poznan. Rents for warehouse space remained low and stable in the regions because of the numerous projects under construction and competition between developers.

Quite high rates, within the range of EUR 2,50-3,20 sq m/month were found in Lodz and the Bielsko-Biala sub-region. Due to the small supply of investment plots and strong competition from other commercial sectors, Krakow is also one of the most expensive logistic hubs. The rents are keeping on a level above EUR 3.00/sq m in this location.

The rent for the warehouse in 2017 – Will the rents rise?

Renata Osiecka, Managing Partner at AXI IMMO, point out that the opportunity to negotiate rates depends on owner type and stage of the project. In most locations where existing facilities are managed through investment funds, the ability to negotiate rates below market averages is limited. It is different in the case of new facilities where the developer wants to have a pre-let agreement to start a new building or to close a project when the last unit remains free. In this case, the scope for rent holidays and financial incentives for tenants is generally larger.

In 2017 rents on the Polish industrial market are expected to remain stable. Currently, there are 1.3 million square metres under construction, of which 27% are speculative investments. This projects might limit pressure on increasing effective rental rates.

Further information about warehouse rents and Polish industrial market is given in the AXI IMMO’s report:

⇓ Industrial market in Poland – summary 2016 PDF|2 MB

Recent articles

14 April 2025

New Work expands in Warsaw with new serviced offices space at Metron building, AXI IMMO advises

Serviced offices at New Work in Warsaw, just steps away from Metro Wierzbno station.

9 April 2025

Central Poland Industrial Snapshot – Analysis of the industrial and logistics real estate market in Central Poland, AXI IMMO publication

High industrial take-up in Łódź region in 2024 driven by lease renewals

3 April 2025

AXI IMMO presents its analysis of the industrial & logistics market in Małopolska, southern Poland

Małopolska on developers' spotlight: more space for industrial and logistics on the horizon.

24 March 2025

Office market in Kraków 2024, Poland, publication by AXI IMMO, 2025 March – Analysis, trends, forecasts

Kraków is the leader of regional office markets – tenant activity is growing. AXI IMMO's special publication on Office market in Krakow in 2024, Poland includes an analysis of supply, demand, rental rates, as well as trends and forecasts on the Krakow office market in 2025 and 2026.