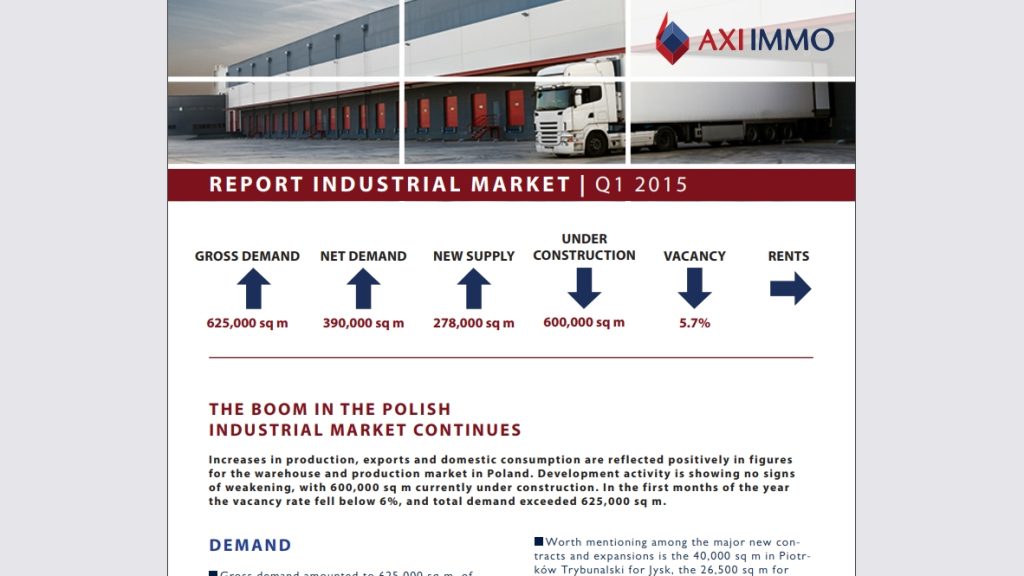

Report: Industrial market in the 1Q 2015

The boom in the Polish industrial market continues. Increases in production, exports and domestic consumption are reflected positively in figures for the warehouse and production market in Poland.

The boom in the Polish industrial market continues. Increases in production, exports and domestic consumption are reflected positively in figures for the warehouse and production market in Poland. Development activity is showing no signs of weakening, with 600,000 m2 currently under construction. In the first months of the year, the vacancy rate fell below 6%, and total demand exceeded 625,000 m2. See the Report: Industrial market in the 1Q 2015 developed by AXI IMMO”‘s experts.

If you want to download the whole Report: Industrial market in the 1Q 2015, click below:

| Download a full version of the AXI IMMO report: | Report: Axi Immo report I Q 2015 | Download PDF | 131 KB |

Demand

Gross demand amounted to 625,000 m2, of which more than 390,000 m2 constituted new leases. This figure is 25% higher compared with QI 2014 and is the best opening of the year in terms of demand in the history of the market for modern warehouse space in Poland. In Q1 2015, logistics operators predominated in the structure of tenants, though increased clients activity related to the DIY and automotive sectors were visible.

Central Poland enjoyed the greatest interest among tenants, where 152,000 m2 was rented. This was followed by Warsaw (120,000 m2) and Upper Silesia (95,000 m2). The highest level of new demand was recorded in Poznan, where 74,000 m2 was rented.

The first quarter, in terms of demand, belonged to mature markets and smaller regions, such as Rzeszow and Szczecin. It is worth noting that a significant part of the demand, around 15%, consisted of expansions. This reflects the good market conditions and the development of tenants – commented Renata Osiecka, Managing Partner at AXI IMMO.

Supply

Since the beginning of the year, 278,000 m2 of modern warehouse space has been completed, which increased the volume of total supply to 9.1 million m2. After the first quarter, the largest amount of space under construction, including speculative space, remains in the Wroclaw region (101,000 m2). Apart from the main markets, increased activity among developers in smaller markets can be observed. 100,000 m2 is currently under construction in Szczecin, Lublin and Rzeszów.

One of the driving forces of development activity is the low vacancy rates in most regions. An increasing number of tenants from different industries need space immediately. A developer that has available space has a significant competitive advantage. This was an important factor in leases in Piotrków Trybunalski and the Warsaw area in the last quarter – added Renata Osiecka, Managing Partner at AXI IMMO.

In most regions, the vacancy rate fell and at the end of March 2015, it amounted to 5.7%. The largest decrease occurred in Central Poland, especially in Piotrków Trybunalski, where the rates have fallen from 14,2% at the end of 2014 to below 5%. The highest vacancy rate was 11.3% in the Warsaw area. In the coming months, we can expect a slight increase in the vacancy rate in Wroclaw, where over 40% is speculative space.

Vacancy rate

A low vacancy rate continues in the Central Poland region, where production companies make up a significant proportion in the structure of tenants, while a lack of typical speculative projects is noticeable. On the other hand, in Piotrków Trybunalski and Stryków, where most contracts are short-term in nature and the tenant structure is dominated by logistics operators, vacancy levels will remain unchanged – said Renata Osiecka, Managing Partner at AXI IMMO.

Rents in most regions in the first months of the year remained stable; slight decreases were recorded in Upper Silesia and Poznan. In the coming months, the minimum downward trend will be observed in the Wroclaw region and in Warsaw.

The figures for the first quarter allow an optimistic forecast to be made for the coming months of the year. Currently, new projects are being carried out in all major storage locations in the country. Most projects that underway have at least one secure tenant, but a significant portion is being built speculatively.

Recent articles

24 March 2025

Office market in Kraków 2024, Poland, publication by AXI IMMO, 2025 March – Analysis, trends, forecasts

Kraków is the leader of regional office markets – tenant activity is growing. AXI IMMO's special publication on Office market in Krakow in 2024, Poland includes an analysis of supply, demand, rental rates, as well as trends and forecasts on the Krakow office market in 2025 and 2026.

19 March 2025

AXI IMMO presents report: Industrial & Logistics Market in the Szczecin region. Summary of 2024, north-west Poland

Zachodniopomorskie Voivodeship – A logistics hub with growth potential

11 March 2025

The packaging manufacturer Preston Packaging is set to join the tenants at MLP Poznań West, Poland, advises AXI IMMO

Preston Packaging in a modern hall tailored to its needs.

7 March 2025

Tomasz Michalczyk appointed as Head of Office Agency at AXI IMMO

AXI IMMO Group strengthens its position as the largest Polish commercial real estate advisory firm by entering 2025 with a new Head of the Office Agency.