AXI IMMO / Warehouses / Górny Śląsk / Bytom /

Industrial properties for lease in Bytom, south Poland

Warehouses and production halls in in an industrial environment in Bytom

The facilities which are the subject of this plan are commercial facilities intended for use

production, warehouse, office, social and workshop, have a structure

mixed brick reinforced with a reinforced concrete skeleton and a steel structure.

The design and equipment allow for predicting changes in their function depending on the situation

owner’s needs and design concepts.

At the moment, the buildings are partly rented, used by production companies and

service.

Workshop building no. 1 is a single-storey building with no basement and a traditional structure. Concrete foundations. Masonry walls made of PGS blocks. The roof is made of prefabricated ribbed panels and is insulated. Concrete floor.Building No. 2 is a single-storey, reinforced concrete structure with a basement, prefabricated. Steel load-bearing skeleton, frame.Production hall no. 3: The building without a basement, single-storey, with a frame structure, reinforced concrete. Reinforced concrete foundations, stairs. Walls of prefabricated reinforced concrete slabs, internal walls made of brick, corrugated sheet. Columns - prefabricated reinforced concrete columns, steel in the gable walls.Multifunctional building no. 4 - social facility. The building has a basement, a two-storey building with a mixed, reinforced concrete and brick construction.The multi-functional office building No. 5 is a two-story building without a basement, with a reinforced concrete frame structure, prefabricated. Reinforced concrete, stepped foundations.Storage shed: foundations - reinforced concrete, walls - partly - trapezoidal sheet, galvanized, columns - steel structure, roof - gable, trapezoidal sheet (not insulated).Wagon scale building No. 7: external walls made of PGS blocks, posts between windows made of full brick, roof - based on Ackerman's ceiling insulated with polystyrene.

Location

The property is located on the route towards Bytom city center - Świętochłowice. Bytom is a city located in southern Poland, in the Silesian Voivodeship, in nearly the 2nd agglomeration of the Upper Silesian Metropolitan Union. It is situated in the south-western part of the Silesian Upland at an altitude of 280-290 m above sea level. The topography of the city is varied, namely it is formed by numerous elevations and depressions. It is located approximately 15 km from the center of the Katowice agglomeration and covers an area of 69.44 km. It borders with: Piekary Śląskie, Radzionków, Tarnowskie Góry, Chorzów, Zabrze, Świętochłowice, Ruda Śląska, Zbrosławice.

Technical data

- Number of buildings3

- Possibility of productionNO

- CertificateNO

- Storage height (m)11.0

- Floor load capacity5.0

- Column grid12 x 6

- Railway sidingNO

- Availability of office spaceNO

- Fire resistance-

- DocksNO

- Ground level access doorsYES

- Cold store/freezerNO

- Office space (sq m)0.00

- Minimal space (sq m)-

- Roof SkylightsNO

- SprinklersNO

- MonitoringNO

- SecurityNO

- Offer IDmp10841

Developer

Conbelts S.A. is a company with a global reach, supporting the promotion of the Polish economy, which participates in many delegations, economic missions and business meetings at the international level. Conbelts S.A. has in its resources a network of hardened roads inside the plant, enabling free access to each facility owned by the company Conbelts S.A.

Distances

Market data

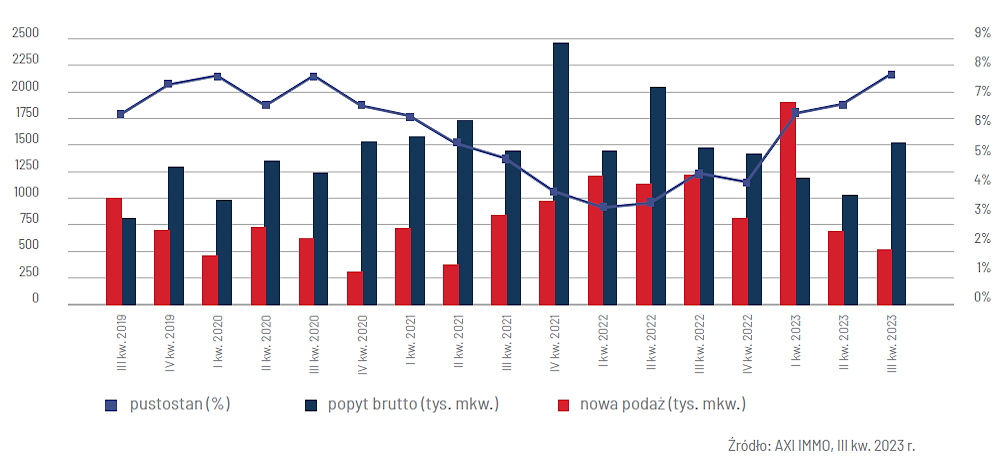

The Warehouse Upper Silesia region (southern Poland) is the second-largest warehouse market in Poland and a key distribution hub for Central and Eastern Europe. The total resources of industrial and logistics space at the end of the 3rd quarter of 2023 amounted to over 5.29 million sq m.

All key developers remain active in the Silesian Voivodeship region, including Panattoni, 7R, GLP, WhiteStar, Logicor, Hillwood, CTP, MLP, Segro, Hines, Prologis, P3, CTP, DL Invest and many local investors. In the period from January to September 2023, the new supply in Upper Silesia amounted to over 471.6 thousand sq m. Developer activity has not had a significant impact on the vacancy rate, which remains at 7%.

The diverse offer of warehouses and halls for rent in the Upper Silesia region consists of large-format big-box and multitenant warehouse halls, exclusive BTO (built-to-own) and BTS (built-to-suit) projects, and smaller urban warehouses SBU (Small Business Unit) to handle the so-called last mile logistics.

Domestic and international companies appreciate the offer of warehouse space for rent in the Upper Silesia region, which enables free transport for companies managing supply chains between Poland, Germany, the Czech Republic, Slovakia, and countries in Southern Europe. Gross demand for warehouses in Upper Silesia at the end of September 2023 amounted to 668.7 thousand sq m. According to developers' announcements, tenants of warehouse space can be confident about development, because another 325.000 sq m are under construction. m2 of modern halls and warehouses.

Companies choose Upper Silesia and development within the Silesian Voivodeship because it is one of the best-developed regions in terms of transport infrastructure. The location of Upper Silesia at the intersection of two main motorways A1 and A4 at the Sośnica JJunction allows for free transport in every direction in Poland. The Silesian region also offers access to the most extensive railway network in Poland and the Katowice airport in Pyrzowice. The main centres related to the local warehouse market remain Katowice, Gliwice, Sosnowiec Mysłowice, Dąbrowa Górnicza, Będzin, Ruda Śląska, Żory and Częstochowa.

Manufacturing and logistics companies, couriers, industry and automotive, retail and food chains, as well as e-commerce are showing great interest in warehouse space for rent in the Upper Silesia region.

Contact

Anna Cholewa

Industrial & Logistics